What Does What Is Trade Credit Insurance Mean?

Some Of What Is Trade Credit Insurance

Table of ContentsThe 9-Minute Rule for What Is Trade Credit InsuranceNot known Factual Statements About What Is Trade Credit Insurance The 9-Second Trick For What Is Trade Credit InsuranceAll About What Is Trade Credit InsuranceThe Of What Is Trade Credit Insurance

ECI, the cost of which is frequently incorporated right into the marketing rate by merchants, ought to be a proactive acquisition, in that merchants must obtain protection before a consumer comes to be an issue. ECI policies are supplied by lots of private industrial danger insurance firms in addition to the Export-Import Bank of the United States (EXIM), the government company that assists in funding the export of U.S.

For extra on credit rating insurance, check out the EXIM site.

The 25-Second Trick For What Is Trade Credit Insurance

Profession Credit history Insurance coverage provides access to information held by insurance firms about the economic health and wellness of firms you are preparing to do organization with. Insurance companies can share this info with their policyholders. Your consumers have a beneficial interest in guaranteeing their suppliers can get trade credit insurance coverage and offer information of their up to day trading task to the insurance providers.

If you are thinking about using invoice financing, trade credit report insurance coverage can give your money firm with the protection they require to supply additional financing. Making Use Of Trade Credit score Insurance to provide consumers as well as potential customers a lot more good credit scores settlement terms and limits. This could have a concrete impact on your sales efficiency.

While we have no recognized link to Julie Andrews, below at The Network Collaboration our team believe in learning more about our client. Above all, please don't think we simply 'supply' trade credit history insurance coverage. Our solution goes beyond that even if you select not to collaborate with us at the end of the day.

The 5-Minute Rule for What Is Trade Credit Insurance

Or, if we believe that credit rating insurance coverage isn't suitable for your organization, after internet that we'll be straightforward and also make the effort to discuss why we assume this is as well as detail alternate options we assume it's the best point to do. We value our people who are the backbone to what we do, and also this is shown in the solution that we supply to our customers.

For the majority of services, the value of the borrower's journal, the cash you are owed, is one of the biggest properties and yet it is usually not insured. The majority of businesses make certain other vital properties readily, yet the danger to a business of customer bankruptcy can be one of one of the most unforeseeable exposures.

Unless you require settlement in advance or are covered by credit report insurance, this makes you susceptible to uncollectable bill (What is trade credit insurance). Ask on your own, what would be the effect of among your biggest customers stopping working to pay you? Any kind of business selling products and also services on credit report terms with direct exposures to uncollectable loans must highly consider trade credit report insurance policy as component of their business risk technique.

Profession Credit Insurance is heavily used in the Structure and Construction market as well as used by services of all dimensions with minimal annual turnover typically starting around $750,000 upwards. There is no 'one size fits all' method when it concerns Trade Credit Insurance and the level and also price of your plan will certainly be determined by your demands.

The smart Trick of What Is Trade Credit Insurance That Nobody is Discussing

For two years service has been damaged. We have a broad option of products assured to guarantee your service against the unanticipated; locate out which one works for you.

Our major emphasis is to be the leading Trade Credit history, Insurance along with Guaranty & Bonds services supplier, by supporting our customers' expanding need throughout, Africa. Get an informative, inside search profession credit scores insurance policy with our latest news as well as updates.

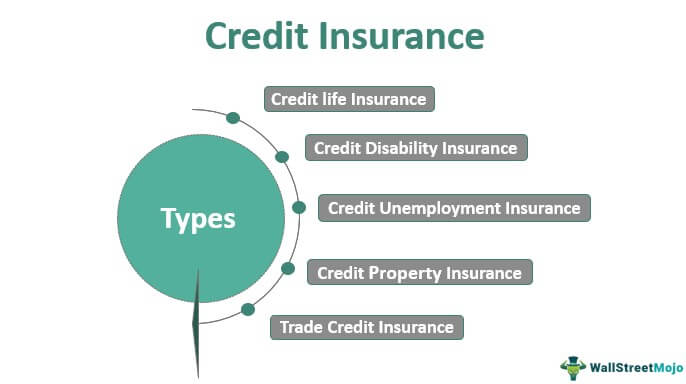

Trade credit report insurance policy is an approach of protecting your accounts receivable (invoices) from non repayment. It is a progressively prominent type of security against clients which either decline to, or can not, pay their financial obligations. What is trade credit insurance. Allow's discover out exactly how it have a peek here functions Contents Profession credit scores insurance, occasionally called 'uncollectable loan defense', is an insurance cover for businesses versus consumers that don't pay their financial debts.

It can be used as a standalone product covering the whole firm balance due; as a bolt on for invoice finance; or to cover a certain part of a business's invoices, for instance those from exports only. Profession credit rating insurance is currently a prominent field with various remedies tailored to different sectors of the market.

Little Known Questions About What Is Trade Credit Insurance.

Experts use what are called actuarial strategies (statistical evaluation of risk in insurance policy) to take a look at the field of trade, the credit report of the companies included, previous uncollectable bill experience and a number of why not check here various other factors. Based on this analysis, the underwriter will certainly develop a credit limitation for each and every company to which the credit insurance coverage will use.

In some circumstances this might not cover the total amount of the profession but a percent only. In addition to its fundamental defense, credit history insurance policy has the added value of using insight into the credit-worthiness of your clients (What is trade credit insurance). This might permit you to make smarter strategic decisions as you grow the service.